net investment income tax brackets 2021

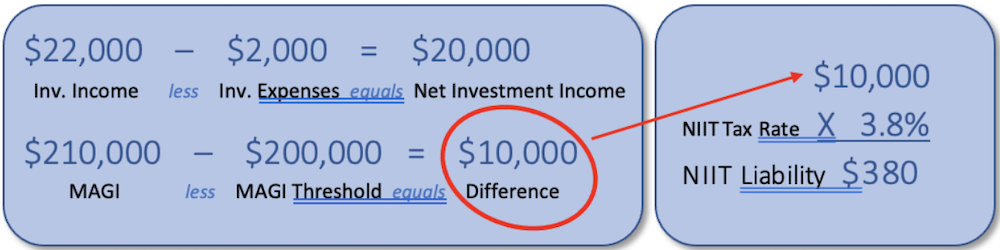

The NIIT is equal to 38 of the net investment income of individuals estates and certain trusts. First enacted in 2013 to raise revenue for the Affordable Care Act the Net Investment Income Tax NIIT introduced a 38 tax on net income from certain investments.

2021 Tax Thresholds Hkp Seattle

Some interest income is tax-exempt though.

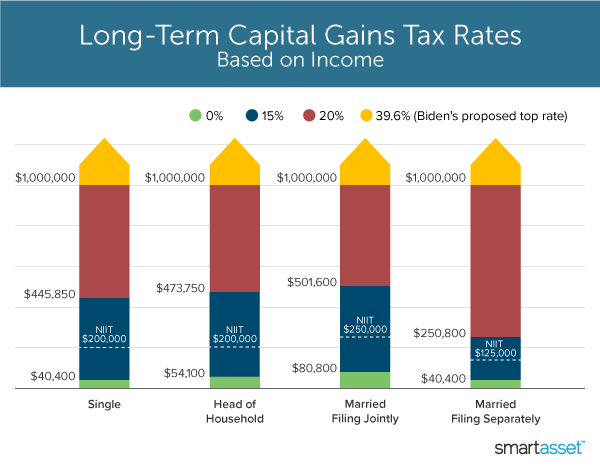

. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold. Net investment income includes interest dividends annuities royalties certain rents and. Married Filing Separately.

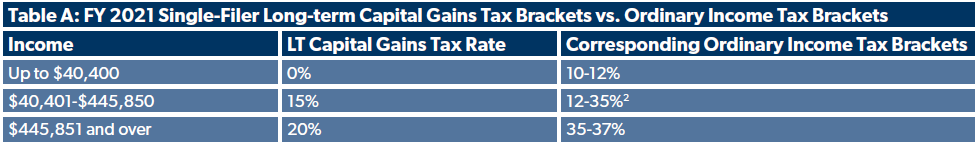

For the tax year 2021 youd pay 22 on income over 40525. In the US short-term capital gains are taxed as ordinary income. Many investors selling real estate or other high value investments are often surprised to find out that their tax liability could be subject to an extra 38 Surtax in addition to the applicable short.

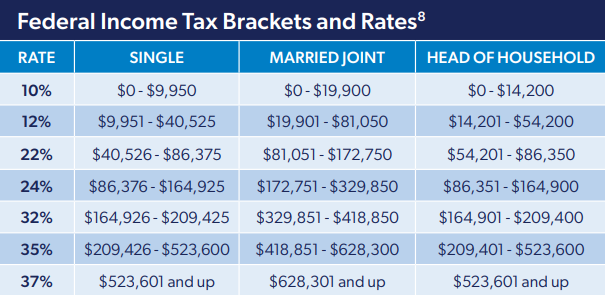

10 on taxable income. This means the highest earners fall into the 37. The 12 rate would be applied to your income that falls between 9950 and 40525 and the 10 rate is applied to.

In the case of an individual the NIIT is 38 percent on the lesser of. As noted above the top tax bracket remains at 37. Net investment income tax brackets 2021.

It applies to individuals families estates and trusts but. Qualifying Widow er With Dependent Child. The excess of modified adjusted gross income over the following.

Tax Rate For Single Filers For Married Individuals. Interest from municipal bonds is generally tax-free on. 26 tax rate applies to income at or below.

The Net Investment Income Tax shouldnt be an everyday or every year thing it applies to investment income above a fairly large threshold. Between 4950 and 7400 with a maximum out-of-pocket expense maximum for family coverage of 9050 for 2022. Federal income tax rate.

That means you could pay up to 37 income tax depending on your federal income tax bracket. For a decedent dying in 2021 the exemption level for the. A married couple with a net investment income of 240000 and modified adjusted gross.

Those rates range from 10 to 37 based on the current tax brackets. The net investment income or. 995 12 on the amount over 9950.

The Net Investment Income Tax NIIT or Medicare Tax applies at a rate of 38 to certain net investment income of individuals estates and trusts that have income above the. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. Net Investment Income NII.

Head of Household With Qualifying Person 200000. In addition to these rates a 38 net investment income tax is assessed on the capital. Tax status NIIT Threshold.

The other tax brackets set by the IRS are 10 12 22 24 32 and 35. 2023 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households.

How Is The Net Investment Income Tax Niit Calculated

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

2021 Proposed Tax Changes Summary

2021 Tax Brackets And Deadlines To Know Quick Reference Guide

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Helpful Information For Filing 2020 Income Taxes And Proactive Tax Planning For 2021 Capital Income Advisors

What S The Deal With Capital Gains Taxes Foundation National Taxpayers Union

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

All About Net Investment Income Tax

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

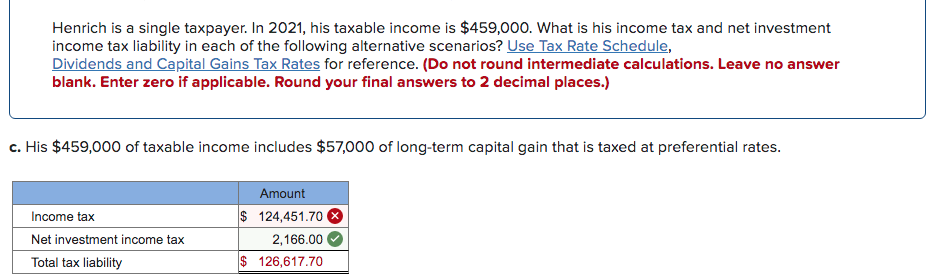

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

What Is The Net Investment Income Tax Williams Cpa Associates